The Roundup by TSG Consumer - Issue #5

A bi-weekly roundup of the latest news and opinions across brand building, consumer companies, and consumer trends from TSG Consumer.

TSG Consumer is a leading private equity firm, and trusted partner in building brands people love since 1986.

What you can expect from this newsletter

A bi-weekly round-up of all things consumer. This is a space for people from across the consumer space to stay up to-date on the latest trends, connect with like-minded peers, and continuously learn from each other

Each issue will feature a curated selection of recent consumer headlines, along with a recap of TSG highlights from across the firm and our partner companies.

Stay tuned for insights that keep you up to speed in the ever-evolving consumer space!

"Nobody wants this" is unlikely

"Somebody will like this" is almost certainly true.

"Everyone needs this" is a trap.

The work begins with finding the right somebodies, while ignoring the imaginary everyone.

Scale is rarely the first signal of important work.

- Seth GodinThe Roundup:

Target blames tariffs: Target blamed tariffs for last week's earnings miss, but Walmart and Home Depot faced identical headwinds without the drama. The NYT identifies four key differentiators: superior supply chain resilience at WMT and HD, Target's discretionary-heavy product mix, the scale advantages that give WMT and HD supplier negotiating power Target lacks, and Walmart's deeper private label penetration. Target remains strategically trapped—chasing both accessibility and aspiration without the operational foundation to excel at either. External pressures simply expose what was already evident: a business model that lacks the focus and efficiency of its competitors. The tariff narrative obscures the real issue—structural disadvantages, not policy headwinds.

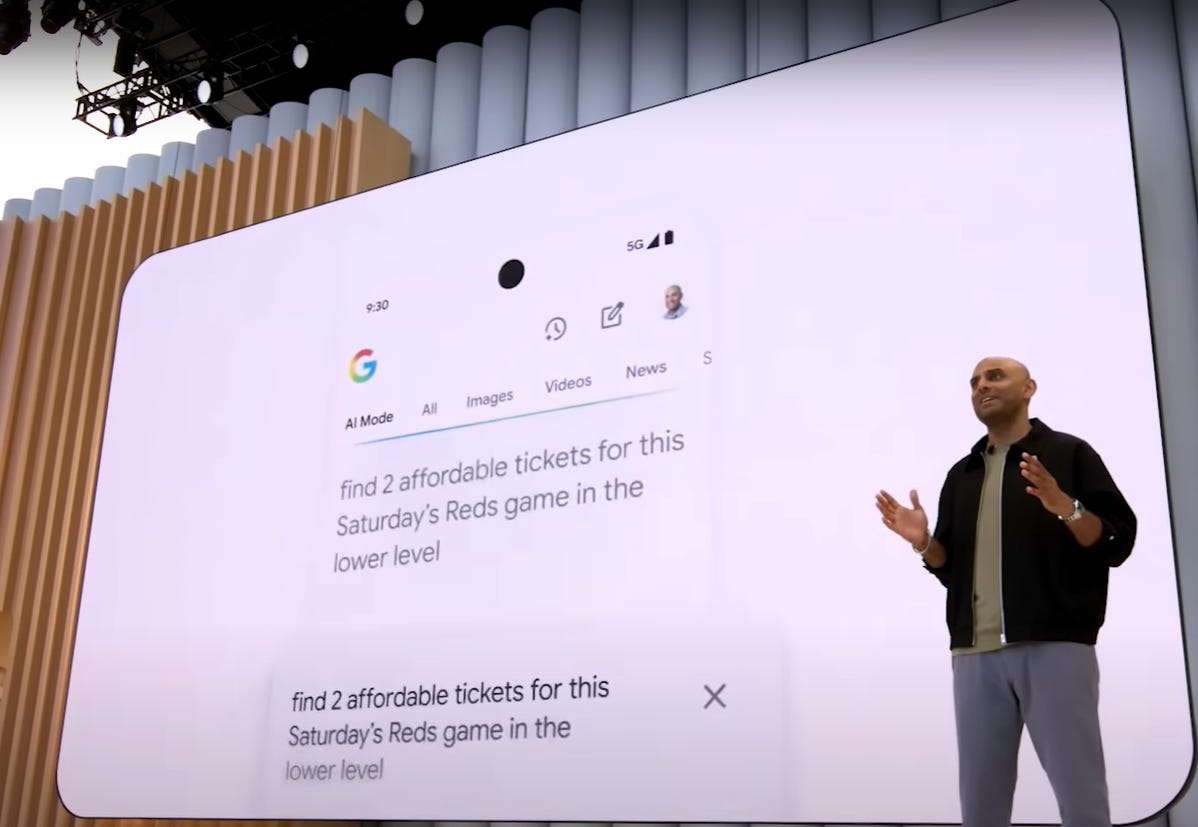

Will LLMs intermediate e-commerce? Google I/O's "Deep Search" demo, where AI responds to "find 2 affordable Red Sox tickets in the lower level for Saturday" by surfacing specific checkout pages, is a glimpse at how discovery might evolve. While it's just a demo, the implications are worth considering. The potential shift could reshape how consumers discover products, moving from browsing to LLM-mediated transactions that prioritize function over brand experience. If discovery becomes increasingly LLM driven, brands will have to start optimizing for a new algorithm - a change that could favor clear, functional value propositions over nuanced brand storytelling.

This scenario would likely accelerate the value of direct customer relationships and repeat purchase behavior, as initial discovery becomes more commoditized. Whether Google's specific implementation succeeds is less important than the underlying trend: consumers are already shifting from traditional search to conversational AI for everything from restaurant recommendations to travel planning. The question isn't whether LLM-mediated discovery will emerge, but how quickly brands will adapt to a world where the algorithm isn't just ranking pages—it's making recommendations. If you’re interested in reading more on “agentic commerce” Scott Friend of BCV has an interesting article here, as does Rex Woodbury of Digital Native here.

Roblox bridging virtual and physical commerce: Vogue Business details the gaming platform’s launch of a new feature allowing brands to sell physical products directly within games to its 97.8 million daily users. Through a Shopify integration, players can purchase real items without leaving the platform—clicking on digital products triggers a checkout window, and buyers receive both the physical item and a digital avatar version. Fenty Beauty is leading the charge with an exclusive lip gloss available only through their Roblox experience. Glossy provides additional context:

U.S.-based players aged 18 and older will be able to purchase physical lip products, including an exclusive-to-Roblox Grape Splash Gloss Bomb, for $22. The limited-edition, holographic purple gloss features a Rhenna head stamped into the cap — a nod to Rihanna’s alter ego and a viral in-game avatar accessory from previous activations.

The logic is compelling: Roblox's own data shows 50% of Gen Z users are likely to consider brands in the real world after trying items virtually. For brands struggling to connect with increasingly elusive Gen Alpha audiences, Roblox offers access to engaged communities and a novel value proposition: buy the product, get the digital twin. It’s exciting to see virtual experience become a legitimate demand generation channel, particularly as traditional acquisitions costs continue to rise.

Creatine's mainstream expansion: Creatine sales surged 65% YoY on Amazon to $241.7M in 2023, with in-person retail jumping nearly 50%, driven by audience diversification beyond traditional bodybuilders into mainstream wellness. The creatine supplement market size is projected to reach ~$4B by 2030, fueled by research revealing benefits beyond muscle gain including cognitive support during sleep deprivation, and potential depression treatment enhancement. Women produce 70-80% less creatine than men yet comprise just 36% of users, representing significant untapped market potential that brands like Arrae, Alani Nu, and Peach Perfect are targeting through social media-driven education campaigns. Despite the growth, 40% of consumers still don't understand creatine's function, creating opportunity for science-backed brands to capture market share through improved positioning and formulation innovations like Create's mushroom blends and enhanced mixability solutions. The timing of creatine's expansion is particularly relevant as two major consumer segments increasingly seek muscle preservation solutions: studies show 20-40% of weight loss from GLP-1 medications comes from muscle mass, while research reveals women can lose 10% of muscle mass during perimenopause alone. What's happened with creatine demonstrates how functional ingredients can break out of niche markets with the right investments in education and broader positioning.

America's $3 billion meat stick obsession: The meat stick has shed its lowbrow reputation and emerged as one of the fastest-growing segments of America's protein-obsessed snacking landscape, with US consumers now spending $3 billion annually on meat sticks. BFY brands are driving 54% YoY growth while incumbents declined 2%, according to Nielsen IRI data. 80% of growth now comes from multipack sales rather than impulse purchases reflecting the broader shift in purchase intent. This transformation mirrors America's protein renaissance, where ~50% of consumers snack three or more times daily and ~60% increased protein consumption in 2024 (up from ~50% in 2023), with ~65% specifically seeking protein in snacks. Two distinct paths drove mainstream adoption: Chomps built from CrossFit and Whole30 communities before rebranding with their "All stick without the ick" tagline when they hit Trader Joe's, while Righteous Felons applied the craft beer playbook with artisanal positioning and now sells in over 10,000 locations including Costco. Newcomers are capturing premium positioning through grass-fed sourcing, sugar-free formulations, and even charcuterie board recipes tapping TikTok's "girl dinner" trend. The takeaway: Categories once relegated to impulse bins can achieve grocery list status when they align with shifting consumer values around functional nutrition, proving that the biggest opportunities often hide in the most overlooked corners of the snack aisle.

The power of a physical presence in the beauty economy: Summer Fridays' weekend popup in NYC for their new guava lib butter balm exemplifies how even established beauty brands are leveraging experiential marketing to drive deeper engagement beyond traditional retail channels. The trend extends beyond high-profile launches - Nuuly is taking a similar approach, working with micro-influencers with followings as small as 2,000 to host hyper-local events like book swaps, matcha meetups, and bouquet bars, often in suburban cities where the brand is scaling fastest. Julia Piccone, Nuuly's senior director of marketing, said the popularity of these events speaks to people's desire to access "third spaces." "We're aiming to create spaces where people feel like they're friends of the brand rather than consumers," she added. It seems to be working: Nuuly's subscriber base jumped 53% year-over-year, topping 300,000 members and delivering a $5.2 million profit. Patrick Ta Beauty's first pop-up demonstrates the high-end version of this strategy - fans camped overnight and queued for hours in a 1.5-mile-long line, and despite the $500,000 production cost and not actually selling anything, the brand saw a 28% increase in Sephora sales and a 49% increase in DTC site visits on day one. The strategic decision to gift rather than sell created a halo effect that converted across their entire ecosystem. For digitally-native beauty brands, this playbook - leveraging creator equity and experiential marketing to drive omnichannel performance - offers a blueprint for translating social capital into commercial results without diluting brand equity.

The $880M Hand Sanitizer Status Symbol: Church & Dwight agreed to pay up to $880 million for Touchland, the first-ever brand to make hand sanitizer cool. What makes Touchland such an interesting brand isn't the hand sanitizer market itself, but how they managed to transcend the utilitarian nature of hygiene products to address the needs of a generation that grew up during COVID-19, when hand sanitizer became omnipresent. According to CreatorIQ, Touchland has racked up 16,200 social media mentions from May 2024 to April 2025 (up 90% year-over-year), with social engagement increasing 140% overall and jumping 270% on TikTok. The brand is now leveraging this cultural momentum to expand into fragrances and body mists. The social numbers show a cultural shift where these $10 mists have become status symbols among teens. This connects to what we discussed in our previous issue about Maslow's Hierarchy of Needs: Touchland didn't just solve a hygiene problem, they turned a boring product into something aspirational by reimagining the form factor, scent, and social signaling of what was previously purely functional. As Michael Appler from Trendalytics notes, Church & Dwight's purchase "is less about hand sanitizer and more about buying access to the highest value beauty demog". Touchland is a case study in understanding how Gen Z transforms mundane categories into vehicles for self-expression, demonstrating that any product category can become a canvas for personal branding if you understand the cultural context and emotional needs driving consumption.

From the Archives: Scale Economies Shared

Back in the early 2000s, an investor called Nick Sleep identified a business model that would come to dominate retail: Scale Economies Shared. Unlike traditional retailers who capture scale benefits as higher margins, companies practicing this model pass cost savings directly to customers through lower prices, creating what Sleep called "a virtuous feedback loop."

The mechanism is simple: lower prices drive higher volumes, which generate greater scale, which enables even lower costs, which get passed back as lower prices. As Sleep noted about Costco, this approach "turns size, normally an anchor to growth and returns, into an asset." The result is a competitive moat that widens as the company grows larger.

Today's retail landscape validates Sleep's thesis spectacularly. Amazon's North American retail margins have compressed from 4.3% in 2015 to just 2.9% in 2023, yet revenue grew from $107B to $395B over the same period. Rather than optimizing for short-term profitability, Amazon consistently reinvests scale benefits into lower prices, faster delivery, and broader selection. The company's willingness to operate at near-breakeven retail margins while competitors chase higher margins has created an increasingly insurmountable competitive advantage.

Costco exemplifies the model's power in physical retail. Despite gross margins of just 10.5-11% (versus 25%+ for traditional retailers), Costco generates $254B in annual revenue from just 890 warehouses. Their membership model creates additional customer lock-in while the treasure hunt experience and everyday low pricing ensure customer loyalty that transcends economic cycles.

Walmart, the original practitioner at scale, continues the approach under its "Every Day Low Price" promise. Even as the company invests billions in e-commerce and technology, it maintains its commitment to passing scale benefits to customers rather than shareholders. This philosophy has enabled Walmart to continue growing revenue year after year, while traditional retailers struggle.

Contrast this to our discussion of Target in paragraph (1) which is struggling to find its place in an ecosystem dominated by lower price retailers. Given we’ve almost reached the point where consumers have perfect price transparency and near infinite choice, Scale Economies Shared creates a sustainable competitive advantage precisely because the model demands sacrificing near-term margins for long-term market dominance, a trade-off that separates the Amazons and Costcos from the retailers struggling to stay relevant.

You can find Nick Sleep’s full collection of investment letters here. They are well worth your time.