The Roundup by TSG Consumer - Issue #3

A bi-weekly roundup of the latest news and opinions across investing, brand building, and consumer trends from TSG Consumer.

TSG Consumer is a leading private equity firm, and trusted partner in building brands people love since 1986.

What you can expect from this newsletter

A bi-weekly round-up of all things consumer. This is a space for people from across the consumer space to stay up to-date on the latest trends, connect with like-minded peers, and continuously learn from each other

Each issue will feature a curated selection of recent consumer headlines, along with a recap of TSG highlights from across the firm and our partner companies.

Stay tuned for insights that keep you up to speed in the ever-evolving consumer space!

There aren't trends, there are vectors. A trend creates a vacuum filled by a counter-trend. The vector extends in both directions.

- Rory SutherlandThe Roundup:

Piper Sandler’s annual Taking Stock With Teens survey was released and there were a few things that stood out: (1) Beauty remains top of mind for teens with the average “beauty wallet” sitting at $374, up 10% y/y, (2) Fragrance has been a significant driver of spending. 78% of teen girls and 53% of teen boys reporting wearing fragrance daily - teen boys’ annual spend on fragrance has hit $127 (up from $88 last year), (3) and, unsurprisingly to those tracking the space, Chick-fil-A remained teens’ favorite restaurant chain for the 7th year running. You can find the full report here.

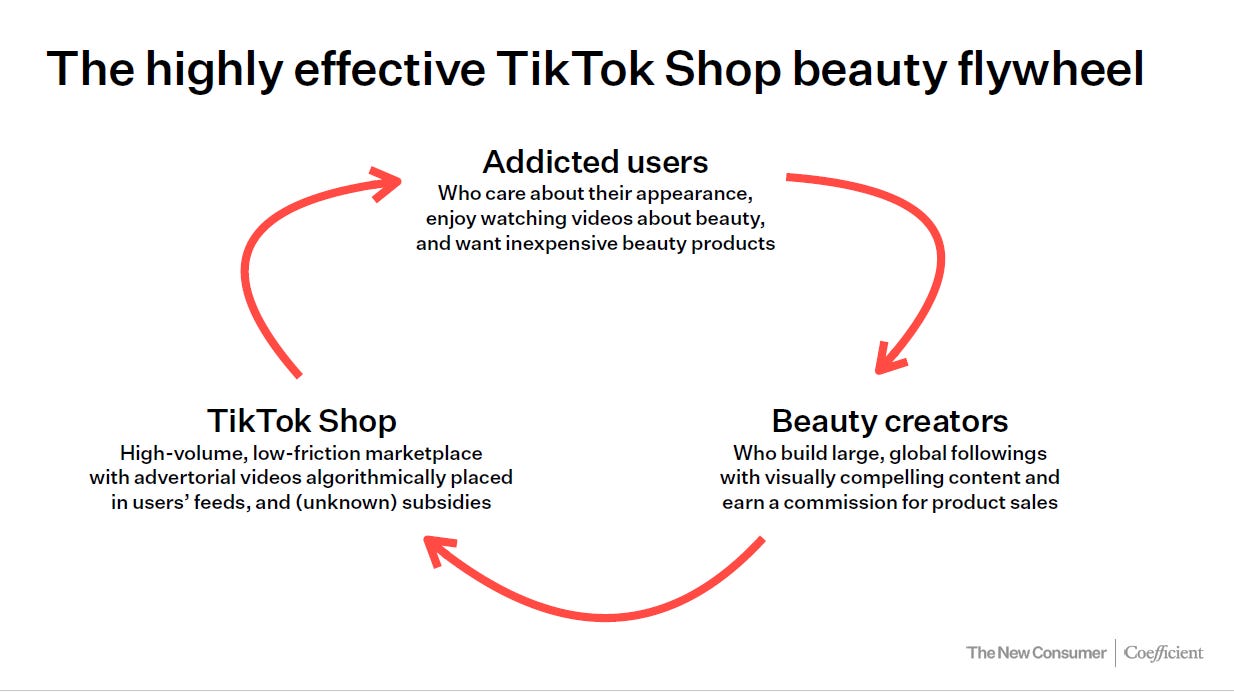

Staying on beauty - Dan Frommer from The New Consumer released his 2025 beauty trends report. Nearly 40% of Gen Z plans to spend more on beauty this year, and 50% expect to increase their routine intensity. TikTok Shop, launched in late 2023, has already converted 57% of daily users into buyers and in aggregate now surpasses Sephora and Shein in total U.S. retail spend—though its beauty sales (estimated at $2B) still trail Sephora and Ulta. It took Ulta 20 years to reach ~$2B in beauty sales. Beauty on TikTok thrives through a content-commerce flywheel of creator-led video, bundled discounts, and instant checkout. Prestige beauty overall reached $34B in 2024, with lip oils (+19% y/y) and fragrances (+12% y/y) leading category growth. Gen Z shoppers prioritize ingredient transparency, video reviews, and authenticity over traditional brand equity. Winning brands are those that act like entertainment-native media companies: fast, transparent, and personalized.

The Financial Times reported that the Chinese tea company Chagee has filed paperwork revealing ambitions to raise ~$400 million in its debut on the Nasdaq. Chagee is a Shanghai-based chain which specializes in coffee-style tea drinks such as “tea-puccinos”, “teas-pressos”, and “tea-lattes”. Chagee won’t be the first Chinese tea house we’ve seen go public this year - Mixue went public on the Hong Kong Stock Exchange in March, raising $444M. It also became the largest QSR chain in the world with 45K units, opening ~21 new units every single day since 2019. It will be interesting to watch if any of the US native brands will be able to replicate the incredible growth of their Eastern counterparts over the next few years.

Bloomberg had a piece profiling the remarkable way Alani Nu has been able to bring women into the energy drink market. Monster Energy and Red Bull have long wished to attract more women but it was with Alani Nu’s launch in 2018 that the industry finally managed to reach the new audience base. Riding on the back of Alani’s success, the percentage of women ages 18 to 34 that consumed an energy drink rose to 37% in 2025, up from 27% in 2023. Before the brand was acquired by Celsius they had reported sales up 69% y/y in Q4 2024.

The Census Bureau reported on April 16th that retail sales at motor vehicles and parts dealers rose to ~$144B in March, +8.8% from the same month last year. This piles on to Kelley Blue Book’s estimates from earlier in April that sales of new vehicles had spiked 30% in March vs. February - the highest total volume in the last four years. Ford reported that sales at dealerships were up 19% in March, and GM showed Q1 sales up 17%. Presumably we’re seeing consumers pull forward major purchases before the impacts from the current administration’s tariff policies flow through to retail prices.

And finally, in another supposed tariff fallout, CNBC reports that Temu has been slashing their ad spend and plummeting in App Store rankings. Not an entirely surprising development given how they’ve been impacted by President Trump’s tariffs and that the business model will be fundamentally altered with the end of the de minimus loophole. Interestingly, China-based advertisers in total are about 10% of Meta’s entire revenue (although Meta won’t lose this revenue entirely thanks to the auction dynamic, but tariffs are likely to hurt auction liquidity), demonstrating how the impact of these tariffs will propagate throughout the whole ecosystem, from mom & pop retailers all the way to internet giants.

From the Archives:

Morgan Housel via the Acquired podcast has some timeless wisdom for us all from Jeff Bezos:

“There’s now a very famous Bezos quote, where he says, ‘People always ask me what’s going to change. But what’s more important is what’s not going to change.’ The more nuanced part of that statement, which he said a couple of sentences later, is, ‘You can never imagine a world in which consumers don’t want cheap prices, fast shipping, and big selection. It’s impossible to imagine a world where people don’t want that. Because of that, you can put so much confidence into investing in those things, knowing they’ll always be relevant in the future.”’

In times like these—defined by economic uncertainty, shifting regulations, and rapid advances in technology—it’s easy to focus on what's changing. But the most effective companies often start by focusing on what doesn’t. The core needs of your customer are remarkably stable over time, and this is arguably true of consumers more than anywhere. Our needs haven’t changed since Maslow first mapped them. Security, belonging, esteem, purpose—these remain constant, even as the tools and expectations around them evolve. If you build your business to serve those needs better than anyone else, you create a foundation that holds up in any environment. Change then becomes something you can leverage, not something you have to fear.