The Roundup by TSG Consumer - Issue #9

A bi-weekly roundup of the latest news and opinions across brand building, consumer companies, and consumer trends from TSG Consumer.

TSG Consumer is a leading private equity firm, and trusted partner in building brands people love since 1986.

What you can expect from this newsletter

A bi-weekly round-up of all things consumer. This is a space for people from across the consumer space to stay up to-date on the latest trends, connect with like-minded peers, and continuously learn from each other

Each issue will feature a curated selection of recent consumer headlines - stay tuned for insights that keep you up to speed in the ever-evolving consumer space!

In the beginner's mind there are many possibilities, but in the expert's there are few

- Shunryu SuzukiThe Roundup:

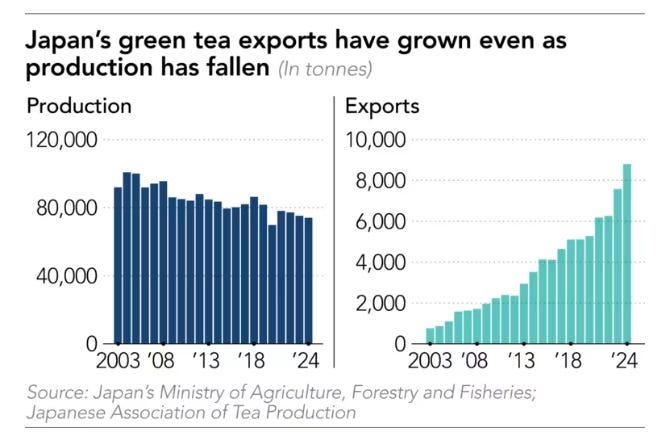

The Matcha Boom (Nikkei Asia, Tamayo Muto): While Japanese green tea exports have surged 10x over two decades, with the U.S. alone taking 44% of powdered tea shipments, Japan's overall tea production has actually fallen 27% since 2004 to 74,000 tonnes. Matcha's supply chain faces unique constraints that make rapid expansion unlikely. The industry's traditionalist culture runs deep, with farmers refusing export opportunities despite visitors arriving with empty suitcases to fill. Most Kyoto tea farmers are over 65, lacking both capital and inclination to expand after decades of declining prices. They view the matcha craze as another fleeting bubble driven by social media influencers. Labor shortages compound the problem, with farms relying on local housewives for the two-week picking period and lacking desire to mechanize. While China and Korea can ramp up lower-quality production, the high-grade matcha popular in America ('ceremonial grade' is a Western marketing term) faces structural supply constraints. In this case, quality comes from a centuries-old supply chain that is unlikely to scale quickly, meaning price inflation is likely to follow, and this is before considering the 15% tariff placed on Japan by the current administration.

How SharkNinja took over the home (The Verge, Nilay Patel) : Consumer durables face a brutal reality: development cycles keep accelerating while replacement cycles keep extending. SharkNinja has cracked this puzzle through relentless product development, launching 25 ground-up products annually across 37 categories and powering their stock to a nearly 3x return since the 2023 IPO (currently trades between 15-20x LTM EBITDA). The company employs 1,300 engineers who obsessively study consumers (watching people cut hair off vacuum brushes with knives led to their self-cleaning brushroll), while spending 7% of sales on R&D versus the industry's 1%. At $6 billion in revenue across 27 countries, SharkNinja is another example of how modern economies reward scale. The company invests 18% of revenue (11% on marketing, 7% on R&D) into growth, maintains apps for 5-year-old products without subscription fees, and amortizes engineering expertise across categories, supporting costs that a smaller player couldn’t hope to match. The payoff is they can make seemingly irrational investments like updating free apps monthly for years, knowing that many vacuum customers end up becoming grill buyers. The company has built a compounding innovation advantage that lets them obsolete their own products faster than competitors can copy them.

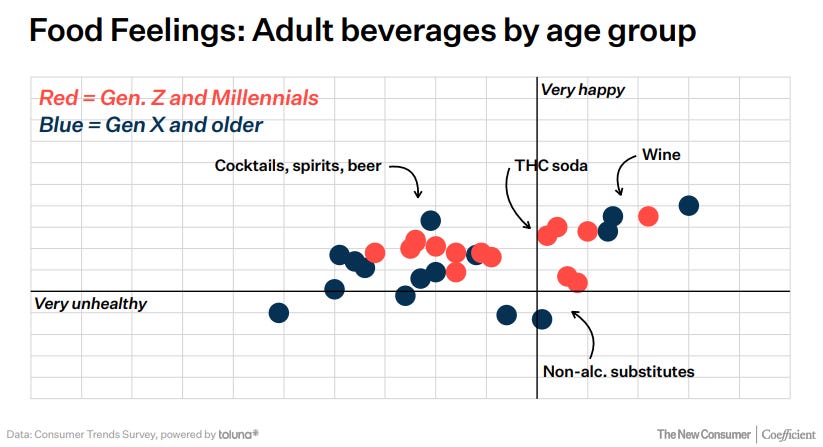

Dan Frommer’s Mid-Year 2025 Consumer Trends Report: There were a myriad interesting insights in the latest report. One of note: The food matrix (how a food ranks on happiness vs. healthiness) reveals how generational divides are reshaping American food culture. The alcohol category shows a noticeable split: younger consumers cluster their happiness around cocktails, spirits, and beer, while older generations gravitate firmly toward wine. THC sodas emerge as probably the most generationally polarized product, indexing as significantly happier for younger consumers while older Americans place them in unhappy territory. Even seemingly neutral foods show generational rifts: seaweed snacks index happier for older consumers, while younger Americans embrace them less enthusiastically. Non-alcoholic alternatives reveal another insight, occupying a peculiar "unhappy but less unhealthy" quadrant that suggests they're purchased for function rather than pleasure (though breakout brands like Athletic Brewing likely buck this trend). The data exposes a psychological tension we all can recognize: while people intellectually know kale and cauliflower rice are healthy, it's pizza, chocolate, and steak that deliver joy. With 69% of Americans saying treating themselves with food is important for mental health, the winners will be brands that either honestly own their position in one camp, or somehow bridge the health-happiness divide.

Throne Bathrooms and The Tragedy of the Commons (WSJ, Christopher Mims): Throne Bathrooms represents a market solution to public restroom degradation. Traditional public bathrooms suffers from a broken feedback loop, whereby the benefit of use accrues entirely to the user, but the costs of abuse (vandalism, mess, neglect) is shared across all future users. In other words, there is no feedback mechanism to discourage abusive behavior. The result is sadly predictable with facilities becoming so degraded that they become unusable, leaving cities with a shortage of usable public bathrooms. Throne's subscription model privatizes access while maintaining the public good nature of the service, creating the missing feedback loop. By tying bathroom access to identity (via app-based entry) and payment, Throne creates accountability. Users who abuse facilities can be banned; those who value clean bathrooms reveal their preference through payment. The model mirrors how private gyms solved the equipment abuse problem or how toll roads manage congestion. What are other cases of broken feedback loops with public goods? Payoffs await for anyone that can restore them.

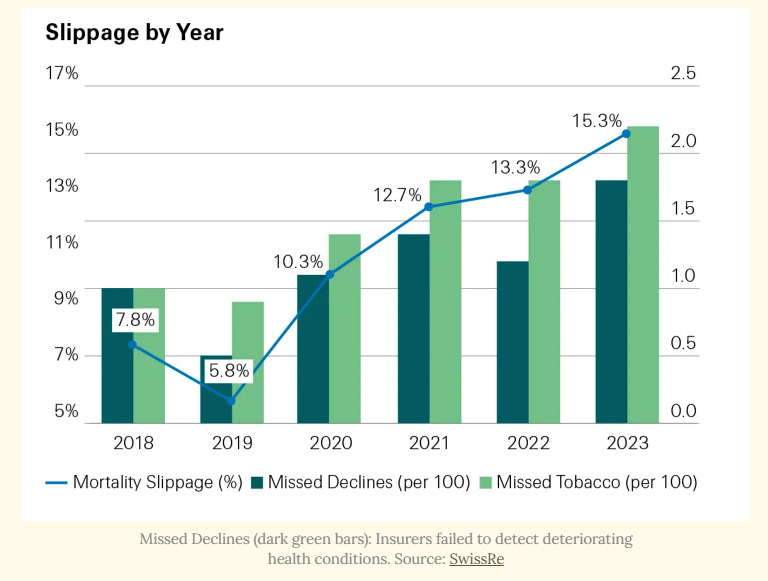

GLP-1s are breaking life insurance (GLP-1 Digest, Ashwin Sharma, MD): Morbid as it might sound, life insurers have built their business on predicting death with 98% accuracy. But mortality slippage (when insurers misprice risk) in life insurance has nearly tripled since 2019, from 5.8% to 15.3%, meaning one in six policies is fundamentally mispriced. The culprit? GLP-1 drugs create what insurers call "mortality mirages" by dramatically improving the exact metrics used for underwriting (BMI, blood pressure, cholesterol). When 65% of users quit within a year and regain weight, insurers are left holding 30-year policies priced for healthy people who are actually high-risk. This crisis creates a massive opportunity for retention-focused GLP-1 companies. Insurers either have to improve their underwriting process or desperately need partners who can keep patients on these drugs long-term. Solutions can be surprisingly simple: statins saw adherence jump when switching from 30-day to 90-day prescriptions. The first companies to crack GLP-1 retention through friction reduction will capture a market of insurers willing to pay handsomely to avoid catastrophic mispricing.

A couple more quick hits:

Starbucks is bringing back the Pumpkin Spice Latte (PSL) (AP News) on August 26th, even earlier than last year’s September 8th. No secret as to the reason, with the PSL release raising store foot traffic by up to 25%. Worth remembering that the PSL ranked dead last among 20 flavors tested for purchase intent, but the marketing team went with their gut and created one of the largest seasonal releases ever.

The micro-influencer trend we’ve discussed on earlier issues of The Roundup continues to gather steam. The WSJ had an article recently touching on the phenomenon of ‘hot people eating free’, as long as they post about it on social media. Similarly, affiliate link culture is becoming increasingly peer focused (Elle) with platforms like ShopMy (just raised at a ~$400M valuation) offering commission rates of up to 50% on affiliate links to regular people. Both phenomena are evidence that people increasingly trust micro-influencers vs. celebrities, particularly among Gen Z. You don’t need to be an influencer to monetize your influence.

Trader Joes doesn’t exist in London but $3.99 tote bags are reselling for as much as $27 on resale sites (NYT) like Depop and Vinted. You know you’re brand has serious intangible value if your tote bags are reselling for almost 7x retail in a country you don’t even have a physical presence in.

Bloomberg profiles the metoric rise of Fazit - When Taylor Swift wore their glitter freckle patches to a Chiefs game sales spiked 3,500% in 48 hours, generating over $1 million. The company is on track for $40M of revenue in 2025, with just six employees managing everything from a Kansas City warehouse. Fazit joins brands like Little Lies, Popflex, and Forme that Taylor Swift has supercharged