The Roundup by TSG Consumer - Issue #11

A bi-weekly roundup of the latest news and opinions across brand building, consumer companies, and consumer trends from TSG Consumer.

TSG Consumer is a leading private equity firm, and trusted partner in building brands people love since 1986.

What you can expect from this newsletter

A bi-weekly round-up of all things consumer. This is a space for people from across the consumer space to stay up to-date on the latest trends, connect with like-minded peers, and continuously learn from each other

Each issue will feature a curated selection of recent consumer headlines - stay tuned for insights that keep you up to speed in the ever-evolving consumer space!

To evolve is to surrender to choices. To become something new is to accumulate all the things you can no longer be

- Kevin KellyBefore diving into the data, it’s worth noting that while consumer sentiment in 2025 has hit its lowest level this century, real personal consumption in the U.S. remains resilient. Over the past 45 years, there have only been two brief periods of decline, both of which were followed by quick rebounds. History suggests that sentiment is a weak predictor of spending behavior.

The Roundup:

The Great American Fitness Boom (Derek Thompson): Part 1 of Derek Thompson’s analysis of the U.S. fitness boom shows Americans are exercising at record levels, with daily workout participation up 20% since 2003. Under the hood, there has also been a reshaping of fitness culture: Pilates participation exploded by nearly 400% between 2019-2024, while yoga added more absolute participants than any other activity, as Americans traded sweaty group classes like SoulCycle and CrossFit for CorePower, SolidCore, and weightlifting. Income remains the strongest predictor of exercise habits, those earning under $25,000 are three times less likely to be active than those making >$100,000. Leading contributors to the increase are older women (women 65+ doubled their weekly workout minutes from ‘03 to ‘24) and Gen Z, who've transformed fitness into social currency, with early morning workouts increasingly reaching higher status than late-night parties. Gyms (particularly ‘HVLP 2.0’ concepts) and fitness studios have emerged as the new third places, with regular class attendees forming group chats and communities. The data suggests Americans are simultaneously health-maxing and socializing less — trading parties for Pilates, happy hours for hot yoga — a trade-off that will likely continue to define consumer behavior as brands race to capture this rapidly evolving wellness market.

Clear Whey and Protein Soda (Cremiux): Cremiux profiles the development of clear whey and reviews a number of protein soda brands. Traditional whey protein clumps and clouds at the acidic pH of fruit drinks, making everything look like watered-down yogurt. Researchers needed six iterations to solve the clouding problem:

Swapping whey concentrate for cleaner isolate

Controlling calcium/phosphate ions

Pre-acidifying proteins before spray-drying (so it arrives "at pH")

Minimizing heat exposure during pasteurization

Using light enzymatic hydrolysis to prevent aggregation

Stress-testing for real-world stability.

The breakthrough wasn't a single discovery but rather "de-risking" a finicky protein through hundreds of trials until it behaved like a cooperative beverage input — colorless, odorless, nearly tasteless protein that dissolves completely at 20-30g per serving. The market response has been predictably rapid. Cremiux profiles the evolution of the category from barely drinkable to genuinely ‘craveable’ products. Genius Gourmet's Sparkling Protein leads on protein to value at $2/can with 30g protein, though they're mixing in cheaper collagen alongside whey. Bucked Up delivers 25g pure whey for $4-5/can with polarizing yogurt-like flavors, while brands like RYSE partnered with Kool-Aid to nail familiar tastes. With ~30g of protein now costing just $2–$3, comparable to ground beef but fruit soda-flavored and ready to drink, brands are expanding into other categories like iced teas/mocktails, gummies, and frozen treats.

Amazon’s Grocery Gambit (Thomas Reiner, Platform Aeronauts): Thomas Reiner of Platform Aeronauts analyzes Amazon’s fifth attempt at cracking grocery—expanding same-day delivery to 2,300 cities by year-end 2025, finally unifying Whole Foods and Amazon Fresh under one "One Grocery" strategy after eight years of keeping them separate. Reiner's analysis reveals why this category remains challenging: last-mile delivery costs ($6-10) plus picking labor ($7-10) exceed grocery's 2-3% margins on every order, making the business structurally unprofitable unless you have either massive scale, existing infrastructure to leverage, or a hidden revenue stream like advertising. The unit economics are punishing across all models. Store-pick costs $15-20 per order (humans walking aisles costs $7-10 in labor plus $6-10 delivery) yet dominates because it requires zero capex. Kroger's bet on Ocado's automated warehouses to cut costs to $8-12 per order has struggled with deployment. Dark stores like Gopuff burn cash on small baskets. Recall Instacart CEO Fidji Simo in her first earnings call saying they "lost money on every order until we got to 100 million orders delivered," and even now profitability comes primarily from advertising revenue, not the 6% commission on orders. This partially explains why grocers privately call Instacart a "necessary evil" — they're not just paying for delivery, they're funding an ad platform built on their customer data. Amazon's response highlights the challenge: simultaneously running stores, dark stores, and rural hubs suggests even they can't determine which model wins. With grocery's inherent 2-3% margins, success requires either Instacart's advertising arbitrage, Walmart's infrastructure leverage, or Amazon's willingness to subsidize losses and iterate. The difference this time is that Amazon has finally integrated non-perishables, Fresh, and Whole Foods after years of separation, suggesting they're betting unified operations can unlock economics that siloed business units couldn’t.

Walmart vs. Target: One of our key takeaways from the recent Target and Walmart earnings calls is that the divergence between the two is stark and getting starker: in eight of the last nine quarters, Target posted negative same-store sales while Walmart's worst comp was +3.8%. But the real story isn't just sales—it's that advertising, membership, and marketplace now drive 50% of Walmart's incremental profit. Walmart CEO Doug McMillon explained the transformation in a prior earnings call:

"When I look at our P&L, it's continuing to change shape... We have a much more diversified set of profit streams now that are both higher growing as well as higher margin."

Meanwhile, Target's new CEO outlined fundamental problems:

"We've identified the biggest challenges that slow us down: legacy technology that doesn't meet today's needs, manual work that can be automated, unclear accountabilities, slow decision-making, siloed goals and a lack of access to quality data."

Walmart's advertising grew 50% globally and 50% of the company’s incremental profit was related to advertising, membership, and marketplace. Most of their edge in advertising comes from Closed-Loop Measurement. They know exactly which ads drive sales because they control both, a capability where even Meta has been stunted after Apple's privacy changes. E-commerce expanded from ~13% to ~17% of U.S. sales in two years, with 20% of deliveries arriving in under 30 minutes, all while gaining share with upper-income customers. Stepping back, while Target certainly has its challenges, it is incredible that Walmart has found a way to grow ~5% organically every period off a revenue base of ~$700 billion. Unless Target can build other revenue streams (their ad network remains subscale) they face competing on purely experience and curation. The risk for any pure-play retailer is that they end up competing on price against competitors that can monetize the same transaction multiple times.

How Pickleball Conquered America (Derek Thompson): Part 2 of Derek Thompson’s analysis of the U.S. fitness boom looks at Pickleball which has grown 311% in three years, from half as popular as badminton in 2019 to surpassing baseball, with 19.8 million players in 2024, potentially the fastest-growing sport in American history. Derek Thompson's analysis shows this isn't unprecedented though; racquetball exploded from 2.8 million to 10.7 million players between 1976-1979 (matching pickleball's growth rate), then collapsed by 70% over the following decades. Tennis went from 32 million players in 1979 to losing two-thirds of participants, only to double again recently. Even roller skating boomed from 3.6 million to 27 million players in the 1990s before crashing back to 6 million today. To explain this phenomenon, Thompson draws on sociologist Stanley Lieberson's theory of "familiar surprises" from studying baby names, explaining that people gravitate toward things that are optimally new without being completely alien. As Thompson describes the pattern: "I imagine a dialogue among players across time: 'Table tennis is fun'; 'But isn't real tennis better?'; 'Except, now I want to play inside: racquetball!'; 'Actually, squash is more fun'; 'But pickleball is less intensive!'" He identifies pickleball's appeal as "80 percent checkers, 20 percent chess: It has a very low barrier to entry and a surprisingly high ceiling for mastery." Thompson's historical analysis suggests no racket sport dominates American culture for more than five years, though pickleball may prove different — it has broader demographic appeal than racquetball (which skewed young and male) and benefits from lower physical demands that allow multi-generational play. The network effects of social media could also create stickier adoption than pre-digital sports experienced. The question is whether pickleball's accessibility and modern media create fundamentally different economics than the boom-bust racquet cycles of the past.

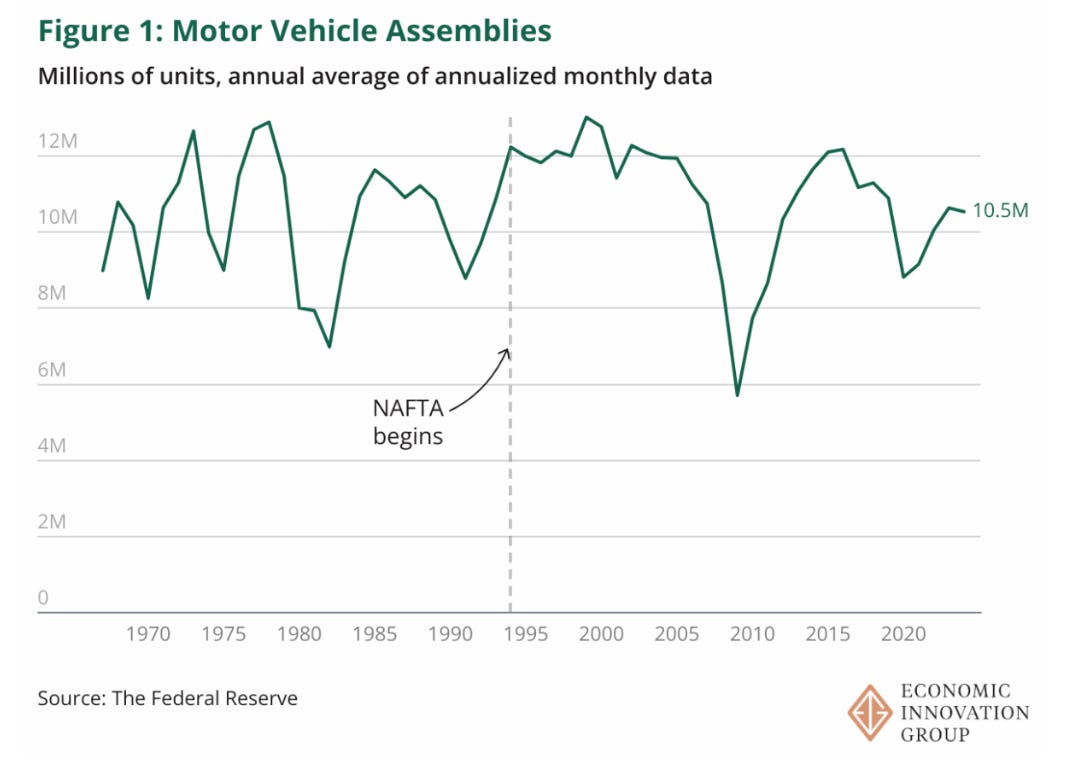

Myths and Lessons from a Century of American Automaking (Adam Ozimek, EIG): Adam Ozimek's new EIG paper challenges four common myths about American auto manufacturing. (1) First, the industry hasn't collapsed: the U.S. assembled 10.5 million vehicles last year, matching the pre-NAFTA average of 10.3 million, and employment remains at 1 million workers versus 1.1 million historically. (2) Second, globalization didn't kill Detroit—the city's auto employment peaked in 1950 at 220,000 workers and fell to under 100,000 by 1970, before Japanese imports mattered. The Big 3 fled militant local unions, with Ford's River Rouge Complex dropping from 90,000 to 30,000 workers between 1941-1960 as production moved to states with cooperative labor. (3) Third, the 1979-82 crisis wasn't about imports: with 18% interest rates and 11% unemployment, domestic production would have collapsed regardless. (4) And fourth, the paper finds that Reagan's Voluntary Export Restraints (VER), which limited Japanese imports to 1.68 million vehicles annually, had no meaningful effect until 1984-85, after the crisis ended and Big 3 profits had hit $10 billion. Japanese automakers were already investing in the US here anyway — Honda was manufacturing in the US by 1979, Volkswagen by 1978 — driven by the economics of manufacturing and logistics, not policy. The real story seems to be interstate competition: Michigan lost 280,000 auto jobs since the 1950s while total U.S. employment barely changed, as production shifted to right-to-work states.

A couple more quick hits:

With social media algorithms making reach less predictable, brands have been shifting their content strategies from one-off creator partnerships to episodic mini-series that build on ongoing audience engagement (ADWEEK). Argos’ Arghaüs is one example ADWEEK calls out in the article. Many consumers don’t even realize they are consuming an advert.

Staying on social media - Business Insider reports on Facebook and Instagram’s transformation from social media to media, highlighting that in 2024 users spent only 17% and 7% of time looking at content from friends on Facebook and Instagram respectively. The remaining time on the platform is spent consuming content from third parties, meaning social media is really a misnomer at this point.

Keurig Dr Pepper is acquiring JDE Peet's for $18 billion, then immediately splitting into two companies, unwinding its questionable 2018 merger to create a $16 billion global coffee business and an $11 billion beverage company. Analysts called the original merger "odd and left field with questionable logic of combining coffee and carbonated soft drinks."

Why is everything spicy now? The Atlantic has an article calling out that Americans are embracing spice at unprecedented levels, with 19 out of 20 U.S. restaurants now offering something spicy. It appears that Gen Z is driving the trends, with 51% of those surveyed identifying as “hot sauce connoisseurs.”

The NYT explains how Gen Z has embraced "treat culture"—regularly buying small luxuries like $12 coffees or $30 key-ring dolls for self-care and mental health, with over half purchasing treats weekly despite 59% admitting it leads to overspending. The phenomenon, amplified by TikTok's 23 million "sweet little treat" videos, offers young adults a temporary sense of control amid rising costs and unattainable financial milestones like homeownership, though many are now setting budgets ($25 biweekly) to manage the habit.

If protein bars and protein drinks aren’t doing it for you then maybe cottage cheese collagen ice cream will.