The Roundup by TSG Consumer - Issue #8

A bi-weekly roundup of the latest news and opinions across brand building, consumer companies, and consumer trends from TSG Consumer.

TSG Consumer is a leading private equity firm, and trusted partner in building brands people love since 1986.

What you can expect from this newsletter

A bi-weekly round-up of all things consumer. This is a space for people from across the consumer space to stay up to-date on the latest trends, connect with like-minded peers, and continuously learn from each other

Each issue will feature a curated selection of recent consumer headlines - stay tuned for insights that keep you up to speed in the ever-evolving consumer space!

We should be rigorous in judging ourselves, and gracious in judging others.

- John WesleyThe Roundup:

High costs are straining Americas love affair with cars: The WSJ had an article a few weeks ago on the rising cost of car ownership and the effect it’s having on younger Americans. The numbers paint an interesting picture: Light-vehicle sales have fallen by about 1.7 million a year since 2016, while the average age of passenger cars on the road is now 14.5 years - suggesting people are holding onto their vehicles longer than ever. The financial pressures are coming from all angles: garage repair costs up over 43% in six years, with the average single repair across all types of vehicles costing $838 in 2024. Part of the challenge appears to stem from the increasing sophistication of modern vehicles, which, while improving performance and safety, have also made repairs more complicated. What once required basic mechanical knowledge now often demands specialized diagnostic equipment and technicians with advanced training (presumably to the benefit of Collision Centers and other “Do-It-For-Me” services). This complexity naturally translates to higher costs for both parts, labor, and importantly, insurance premiums. Given many of these costs end up being born by insurance companies, they either have to tighten underwriting standards or increase premiums to cover the every growing cost basis. The data suggests a broader shift in how younger consumers think about transportation. Rather than simply postponing car purchases, some appear to be exploring alternative models entirely. When ownership involves significant upfront costs, rising insurance premiums, and increasingly expensive maintenance, the economics of going car-free or car-light start to make more sense. Layer this on top of the relentless march of autonomous driving led by Waymo and Tesla and there seem to be multiple trends that could have meaningful implications for businesses across the automotive ecosystem and a country that was built around vehicle ownership.

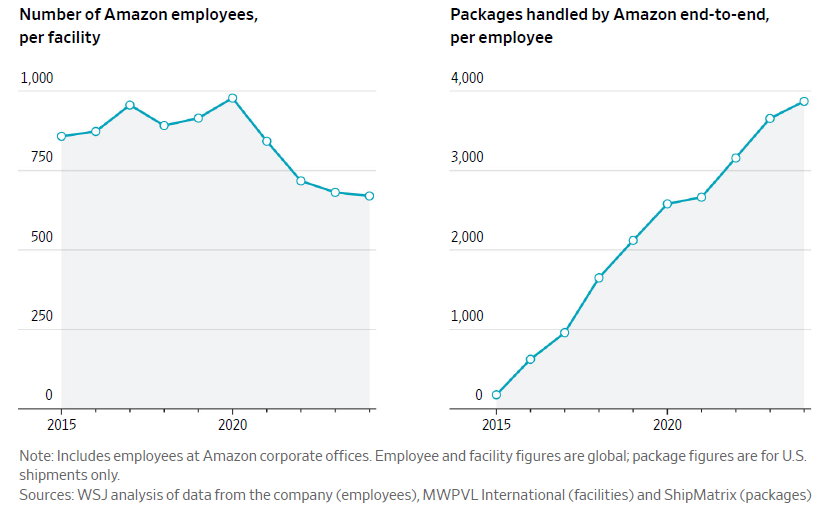

Amazon quietly crosses a remarkable threshold: Another excellent article from the WSJ - Amazon has over one million robots now deployed across its warehouses, and is approaching parity between its robotic and human workforce. The e-commerce giant, which has spent years automating tasks previously done by humans in its facilities, has deployed more than one million robots in those workplaces, while employing roughly 1.56 million people overall. The transformation is striking - some 75% of Amazon's global deliveries are assisted in some way by robotics, and The average number of employees Amazon had per facility last year, roughly 670, was the lowest recorded in the past 16 years. Over a decade ago, Amazon made a pivotal move by acquiring a robotics company called Kiva Systems. That acquisition, according to one former head of systems and products at Amazon Robotics, was based on the fact that "roughly 50% to 60% of the labor costs in a warehouse were due to the time spent walking to pick up inventory." This automation strategy embodies the idea of scale economies shared that we’ve touched on previously in The Roundup. As the graphs below show, productivity gains have been dramatic - The number of packages that Amazon ships per employee each year has also steadily increased since at least 2015 to about 3,870 from about 175, a 22-fold increase. But, rather than banking these efficiency gains, Amazon reinvests them into customer benefits: same-day delivery, lower prices, and expanded selection. Over time these advantages all compound into a network that competitors simply cannot replicate without similar scale and investment.

The Waggle Dance: Rory Sutherland's presentation at Nudgestock 2025 offers a different lens for viewing optimization strategies, drawing on nature's own approach to balancing efficiency and exploration. Bees have evolved a system where a large percentage of the worker bees obey the waggle dance (directing them to a current source of pollen) and a smaller percentage of worker bees ignore the waggle dance. Those 'rogue' bees go off-piste to discover as yet undiscovered rich source of pollen. Research shows that 15-20% don't obey ‘the waggle dance’ instructions. The critical insight is that what appears to be inefficient behavior at the sub-system level is essential for survival at the total system level. While total compliance to the waggle dance would increase pollen collection in the short run, over time, the absence of these punk bees would trap the hive in a local maximum and the hive would eventually starve to death.

Some of the great consumer businesses have had the same insight as the bees - take Banana Ball, which we discussed last issue - they give away free food and price tickets well below resale value, seemingly leaving money on the table. Yet this "inefficiency" creates an atmosphere that converts fans to evangelists, driving growth that far outstrips any short-term optimization could provide. Similarly, Costco famously caps its gross margins, refusing to squeeze customers even when market position allows it. The deliberate constraint on profit-taking drives member loyalty and volume that competitors cannot match. Despite being in completely different industries, both companies understand what the bees have always known: to optimize the total system we sometimes have to sub-optimize the parts. Perfect efficiency is often perfectly fatal in the long-run.

Pop Culture Eats Strategy: In a recent conversation with Patrick O'Shaughnessy of Invest Like The Best, SKIMS CEO Jens Grede offered a number of insights into how he views today’s consumer landscape. A few that stood out to us: (1) He argues that "pop culture today is really the only hack to the consumer economy that we have." Grede illustrated this with a thought experiment - even with one billion dollars in traditional advertising spend, a new vodka brand wouldn't achieve half the recognition of The Rock's tequila. (2) Grede believes "big wins" in this environment for several reasons: social media algorithms now favor engagement over loyalty, making it difficult for young brands to build community organically, while the capital requirements for physical stores create significant barriers (retail remains 80% physical). (3) He sees a cultural shift toward comfort and nostalgia: "Olive Garden, country music, Applebee's is booming. Banana Republic is having the best year in probably decades." And (4) SKIMS broke through this challenging landscape via (a) perfect timing catching the comfort-dressing wave, (b) obsessive product focus ("you have to create a product so great that you will still get to the same place with or without marketing"), a common theme on this newsletter, and (c) Kim Kardashian's cultural reach. While we’ve seen many brands find success with just good timing and exceptional product focus, there is no denying that in today’s environment a pop culture ‘hack’ is a valuable tool to break through the noise. And it’s important to hold in mind that an exceptional product is a pre-requisite to building a long-lived brand. Pop culture without product quality is just a fad.

Sauna Meets Social: Othership's recent $11 million Series A led by Vine Ventures highlights the rapid mainstreaming of contrast therapy in North America’s major cities. Othership expects to add 20 North American locations over the next five years, joining a growing wave of concepts like Bathhouse, Elahani, SweatHouz, and Kove that are transforming the urban wellness landscapes. Many of these are augmenting the traditional bathhouse experience - Elahni is New York's First Wellness Speakeasy, a new kind of social experience complete with ice baths, traditional sauna, adaptogenic tonic bar, and curated library, while Othership offers music-driven guided sessions and "Evening Socials" that position themselves as sober-curious alternatives to nightlife. The timing is apropos, with the concepts tapping into Gen Z's converging obsessions: wellness and community. The well-profiled death of traditional third places - those crucial spaces between home and work (e.g. churches, libraries, malls) - has created a vacuum these wellness concepts are rushing to fill. But it seems a larger aspect to Vine’s investment thesis is that Othership is solving two problems that afflict mental health provision today: (a) making mental health interventions more accessible and (b) providing the community support needed for sustainable behavioral change. One Othership member claimed they've "replaced $800 in therapy per month with Othership” suggesting these spaces might be addressing something deeper than just physical recovery. In an era where young adults are increasingly isolated, anxious, and seeking alternatives to bar culture, contrast therapy studios are positioning themselves as a new piece of social infrastructure.

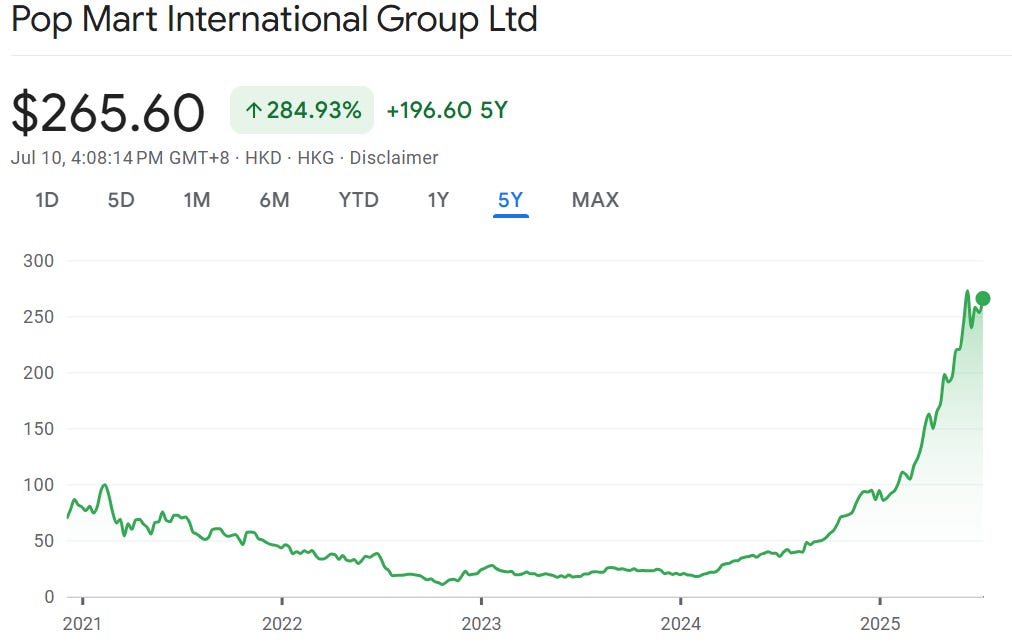

The Labubu Loop: Modern Retail has an interesting short article profiling Pop Mart's Labubu phenomenon and the raw power of TikTok's algorithmic feedback loops. The collectible figures generated ~$5 million in TikTok Shop sales in April alone, up 89% from March, with year-over-year sales surging over 1,000% - dramatically outpacing the platform's overall growth. Pop Mart has a pretty unconventional approach: while most successful TikTok Shop brands work with at least 5,000 creators (Tarte Cosmetics has 20,000), Pop Mart has achieved these results with just 1,300 creators, generating 85% of sales through livestreams rather than pre-recorded videos. The whole phenomenon is a good illustration of what systems theorist Donella Meadows called a "positive feedback loop" - where success breeds more success in an accelerating virality. Each viral unboxing video drives more viewers to livestreams, which create scarcity through instant sellouts, which makes the next unboxing even more compelling, which attracts more viewers. The loop has even expanded beyond TikTok: eBay users searched for "Labubu" over 450 times per hour in May, while revenue for Labubu-inspired products on Amazon surged 1,930% to ~$7 million despite the official product not even being listed there. As digital marketing consultant Noah Mallin observed, multiple subcultures - K-pop fandoms, "kidult" collectors, and blind-box enthusiasts - have converged "like slices of Swiss cheese lining up to make a hole." TikTok's algorithm tends to amplify and accelerate demand rather than reflect it, which has the side effect of transforming niche interests into global phenomena at surprising speed. There’s always a question on the sustainability of these trends. Consumer attention is fickle, and the flip side of exponential growth is exponential decline. While virality certainly makes for an eye catching stock chart, as SKIMS CEO Jens Grede indicated, a differentiated and exceptional product is a pre-requisite to building a long term brand.