The Roundup by TSG Consumer - Issue #10

A bi-weekly roundup of the latest news and opinions across brand building, consumer companies, and consumer trends from TSG Consumer.

TSG Consumer is a leading private equity firm, and trusted partner in building brands people love since 1986.

What you can expect from this newsletter

A bi-weekly round-up of all things consumer. This is a space for people from across the consumer space to stay up to-date on the latest trends, connect with like-minded peers, and continuously learn from each other

Each issue will feature a curated selection of recent consumer headlines - stay tuned for insights that keep you up to speed in the ever-evolving consumer space!

Adjustment to a changing environment is the essence of life, and its price

- Will & Ariel DurantThe Roundup:

The protein craze is reshaping value chains: Three recent NYT investigations reveal how protein is creating ripple effects across every segment of the CPG supply chain:

(1) Raw materials: At Wisconsin's Nasonville Dairy, CEO Ken Heiman breaks even on cheese while profits come from whey, the liquid byproduct that was dumped in rivers when he started in the 1960s. Whey now accounts for 8.7% of dairy farmers' milk checks (the payment a dairy farmer receives for milk delivered to a processor) versus 2.7% historically, with prices tripling from about $3 to $10 per pound since 2020. Taken together, processors are now tuning for whey yield, not just cheese throughput.

(2) Manufacturing: Contract manufacturer YouBar switched to 24/7 production yet still can't meet demand after 85% revenue growth in two years. Its 10,000-bar minimum democratizes access for new brands, enabling the “proteinification” of everything from churros to toaster pastries. The supply bottleneck is so severe that David's founders acquired their key ingredient supplier (E.P.G., a modified fat) and cut off competitors mid-production - triggering antitrust lawsuits but securing the inputs to produce 28-gram protein bars with just 150 calories. In practice, capacity and input control now help determine who ships, not just who markets best.

(3) Distribution & Marketing: David bypassed traditional retail through TikTok Shop, generating $1M in sales their first week and achieving a $725M valuation in nine months after a $75M Series A led by Greenoaks. Science-influencers like Peter Attia (an investor) create the permission structure for premium pricing – their bars cost 10x equivalent whole foods. With the protein-to-calorie ratio approaching that of boiled cod, consumers seem happy to pay premium prices for engineered nutrition.

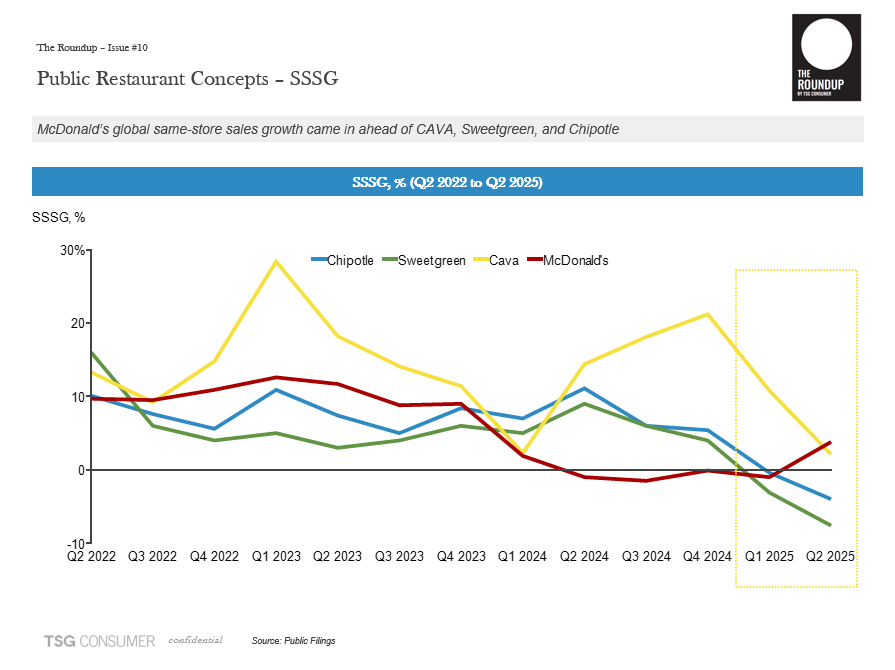

What’s happening with Sweetgreen? Sweetgreen's ~8% decline in same store sales sent their stock down >25% after Q2 earnings. Dan Frommer has an insightful article breaking down what could be driving their struggles. First, if your core customer is a younger, more fickle consumer, it's not enough to be consistent, you have to be innovative. Sweetgreen canned their seasonal limited-time offerings last year to focus on steak but now plans 8+ in 2026. As Frommer observes: "People want new stuff all the time. If they're not getting it from you, they'll get it from someone else." Second, brands can't hide behind "quality" when consumers tighten spending. While Sweetgreen blamed weakness on "a more cautious consumer environment," competitor Cava managed to eek out 2% same-store growth this quarter. Sweetgreen's response is 25% larger protein portions – admitting they'd over-optimized margins at the expense of value. Third, they lost operational discipline at scale. Despite 260 locations and 18 years in business, CEO Jonathan Neman admitted only a third of stores "consistently operate at or above standard." Their Ripple Fries failed after four months when air-frying increased hold times and degraded quality across the menu. On a side note, it’s amazing to see McDonald’s same-store growth start to pull ahead of these fast casual concepts in the last two quarters.

The Chicken Wars (Sherwood News): Speaking of McDonald’s, the Snack Wrap returned in July after a nine-year hiatus, triggering preemptive strikes from competitors that show how deeply chicken has reshaped fast food. The wrap – discontinued in 2016 for being too operationally complex – saw such demand that stores ran out of lettuce within days of its relaunch. But McDonald's announcing the return six months early gave Popeyes time to launch its own wrap in June, while Taco Bell and Sonic piled in with their versions. Popeyes even offered free wraps during McDonald's launch week to steal momentum. The wrap wars are really a proxy battle in chicken's decades-long conquest of American plates. Chicken surpassed beef consumption in 2010 and Americans now eat twice as much as they did in 1970, driven by production innovations that cut growing time from 16 weeks to 6 weeks and halved feed requirements. For restaurants facing margin pressure and consumer pushback on prices, chicken's economics are irresistible – especially wrapped in a tortilla that signals "healthy" and "portable" to protein-obsessed, carb-wary consumers who increasingly snack rather than sit down for meals.

Ferrero to acquire WK Kellogg (NYT): Ferrero is acquiring WK Kellogg for $3.1B ($23 / share). The cereal maker – spun off from Kellogg in 2023 – has been struggling with declining sales (down 3% this year) as inflation-conscious consumers trade down to private label. For Ferrero, this is opportunistic acquisition: buying iconic brands (Frosted Flakes, Froot Loops) from a company that, by the CEO's own admission, lacks resources to compete independently. The Italian giant is betting its family ownership allows patient capital to revive brands that public markets abandoned. With the FTC's approval of Mars-Kellanova signaling a more permissive M&A environment, expect further consolidation. Strategically, breakfast cereals offer habitual consumption patterns that complement Ferrero's impulse-driven sweets portfolio – though both categories face headwinds from evolving consumer preferences.

Allbirds and the DTC Mirage (Residual Thoughts, Joe Hovde) : Allbirds' recent move to wholesale distribution in international markets represents a notable shift from the direct-to-consumer model that once defined the company. The company's 2021 IPO filing articulated the original thesis: cutting out wholesalers would create "a more efficient cost structure and higher gross margin," allowing them to deliver better products at prices "competitors would have difficulty matching." This seemed plausible when digital advertising was cheap. But as more DTC brands competed for the same Facebook and Google ads, acquisition costs rose dramatically. The platforms gradually captured the margin that brands thought they'd saved by avoiding traditional retail – and often more. After raising hundreds of millions at a $1B+ valuation just three years from founding, they were locked into growth expectations that consumer brands rarely meet. Consider Deckers (owner of UGG & HOKA): it went public in 1993 but took 14 years to reach $1B in market cap, building enduring brands with patience rather than capital. Recall that in Issue #6 we discussed how even Nike couldn't make the push into DTC work – ultimately having to return to Amazon, after six years of absence, in an attempt to restart growth having discovered that advertising (8% of revenue) and logistics (12%) costs actually produced worse EBIT margins than wholesale, while competitors like On and Hoka filled their abandoned shelf space.

A couple more quick hits:

Amazon will offer same day delivery on groceries in 2,300 cities - Doordash and Instacart both traded down on the news

A new survey from DKC shows that for U.S. parents with children ages 8-14 the children drive 42% of all household spending - giving them a ~$100 billion in annual purchasing power. Apparently the average child in this age range now has ~$70 per week to spend themselves

16 Handles CEO Neil Hershman believes frozen yogurt's collapse was about execution, not demand – pointing to "icky" stores and broken bathrooms rather than consumer disinterest. The 30-year-old is betting on nostalgia and operational basics, planning 200+ locations nationally despite the sector's contraction (servings down ~30%, stores down ~35% since 2017)

QSR’s annual ranking of America’s 50 largest food chains showed Starbucks was the fastest growing chain, opening 589 locations despite various issues reported this year, while Subway faced the largest decline, shedding 631 stores

Hershey’s Jolly Rancher passed $400 million in sales last year, up 25% year-over-year, despite being 76 years old. Growth was driven by Jolly Rancher Ropes, with hard candy down to less than 50% of sales vs. 80% a decade ago

For those of you not tired of protein yet, Arnold Schwarzenegger just released an 80-page guide on all things protein in partnership with the venison-focused brand, Maui Nui

The Ritz-Carlton in LA is replacing the in-room minibar with beauty fridges that provide luxury skincare regimes so guests can get red-carpet ready without leaving the suite