The Roundup by TSG Consumer - Issue #4

A bi-weekly roundup of the latest news and opinions across brand building, consumer companies, and consumer trends from TSG Consumer.

TSG Consumer is a leading private equity firm, and trusted partner in building brands people love since 1986.

What you can expect from this newsletter

A bi-weekly round-up of all things consumer. This is a space for people from across the consumer space to stay up to-date on the latest trends, connect with like-minded peers, and continuously learn from each other

Each issue will feature a curated selection of recent consumer headlines, along with a recap of TSG highlights from across the firm and our partner companies.

Stay tuned for insights that keep you up to speed in the ever-evolving consumer space!

Failure is an opportunity. If you blame someone else, there is no end to blame.

Lao TzuThe Roundup:

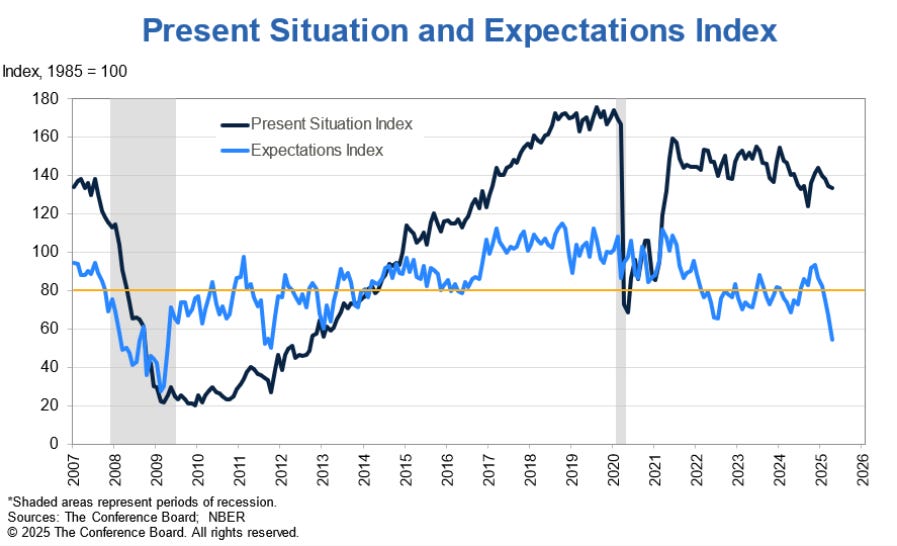

Consumers rarely do what they say they do: Conventional wisdom often assumes that what consumers feel will dictate how they spend. But history tells a more nuanced (and often more positive) story. As the chart below shows, U.S. consumer sentiment has fluctuated over the past 45 years (primarily around major economic shocks), yet real personal consumption expenditures (PCE) have declined only twice, and both instances were modest and short-lived. That divergence has grown even more pronounced in 2025. While sentiment remains near historic lows, real consumer spending continues to grow. The disconnect between what consumers say and how they behave appears to be structural, not cyclical - with a marked change in the relationship post COVID.

Recent data from The Conference Board reinforces this split. In April:

The Present Situation Index stands at 133, well above its historical average of 103—signaling confidence in current job and business conditions.

Meanwhile, the Expectations Index has plunged to 54.4, far below its historical average of 90—reflecting growing anxiety about the future.

In other words, people feel bad but spend anyway. The takeaway: don’t assume that sentiment (how people feel) is an indicator of actual behavior (what people do).

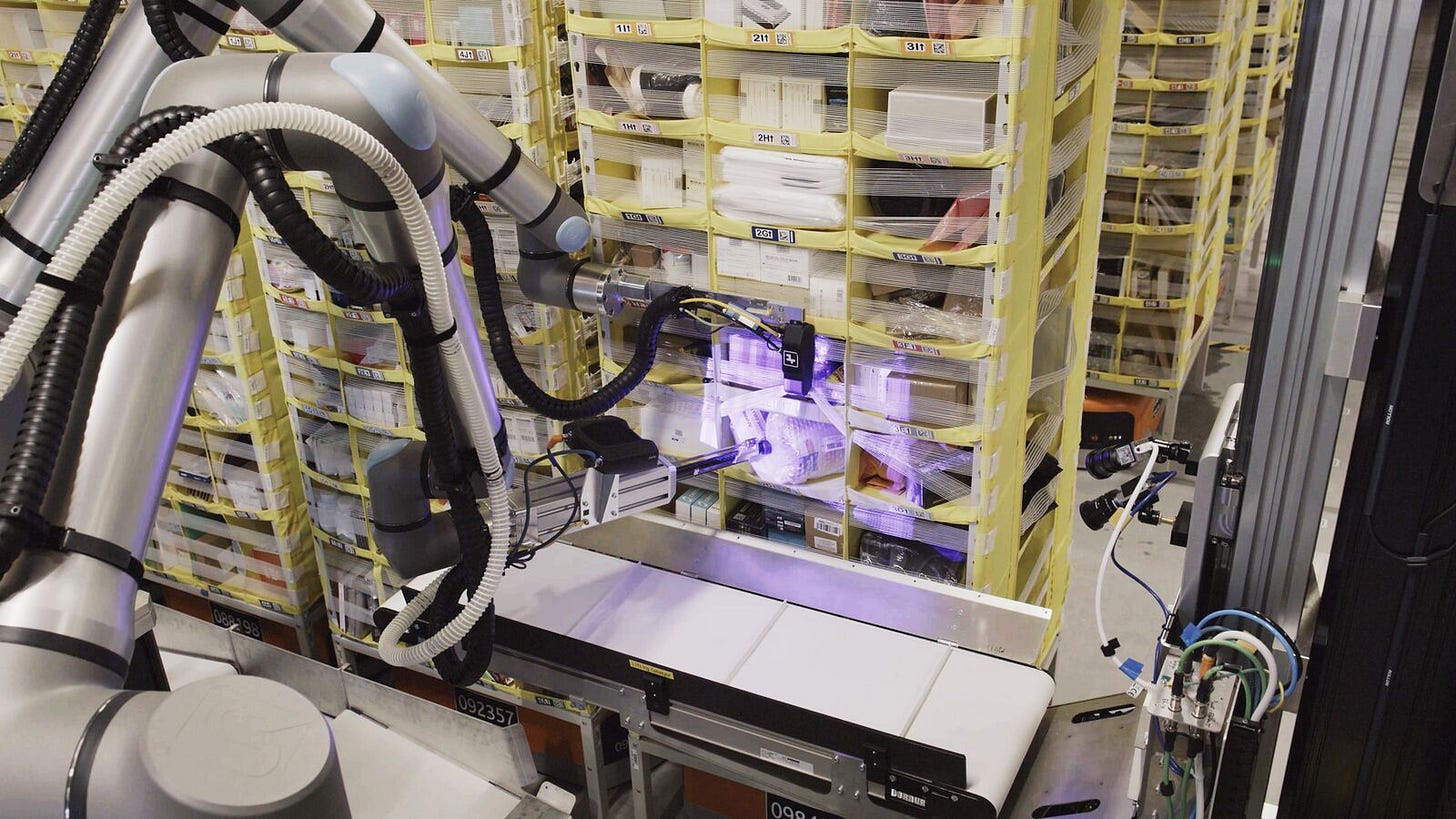

Amazon’s march to automation: Amazon introduces Vulcan, its first warehouse robot with a “sense of touch”. Designed to handle ~75% of fulfillment center items, Vulcan utilizes tactile sensors to adjust grip pressure based on object sensitivity. This enables it to manage a broader range of products than previous models. For more on why fine motor control remains a frontier challenge for robotics, see Brian Potter of Construction Physics’ excellent essay “Robot Dexterity Still Seems Hard”. Presumably this will ultimately work to reduce Amazon’s labor dependencies, and where Amazon goes other 3rd party logistic providers are likely to try and follow.

David’s TikTok masterclass: In under a year, David Protein - a new entrant in functional food - has 50,000+ bars and generated 60M+ impressions through the TikTok shop. In an interview with Rachel Karten, co-founders Peter Rahal (ex-RXBar) and Zach Ranen describe how they built a repeatable growth engine by treating TikTok as a commerce-native platform. Key tactics include twice-weekly live streams with full-time hosts, a structured affiliate marketing program that now includes over 4,000 creators, and a deep operational integration where even new hires are onboarded via live selling shifts. Rather than chasing virality, they focus on conversion-first content, optimizing creative elements using TikTok’s backend tooling. David has been riding a wave of enthusiasm for ‘functional food’, indeed Cargill reported in their 2025 Protein Profile that 61% of consumer increased their protein consumption in 2024, up from 48% in 2023, with 63% of those respondents looking for protein in snacks.

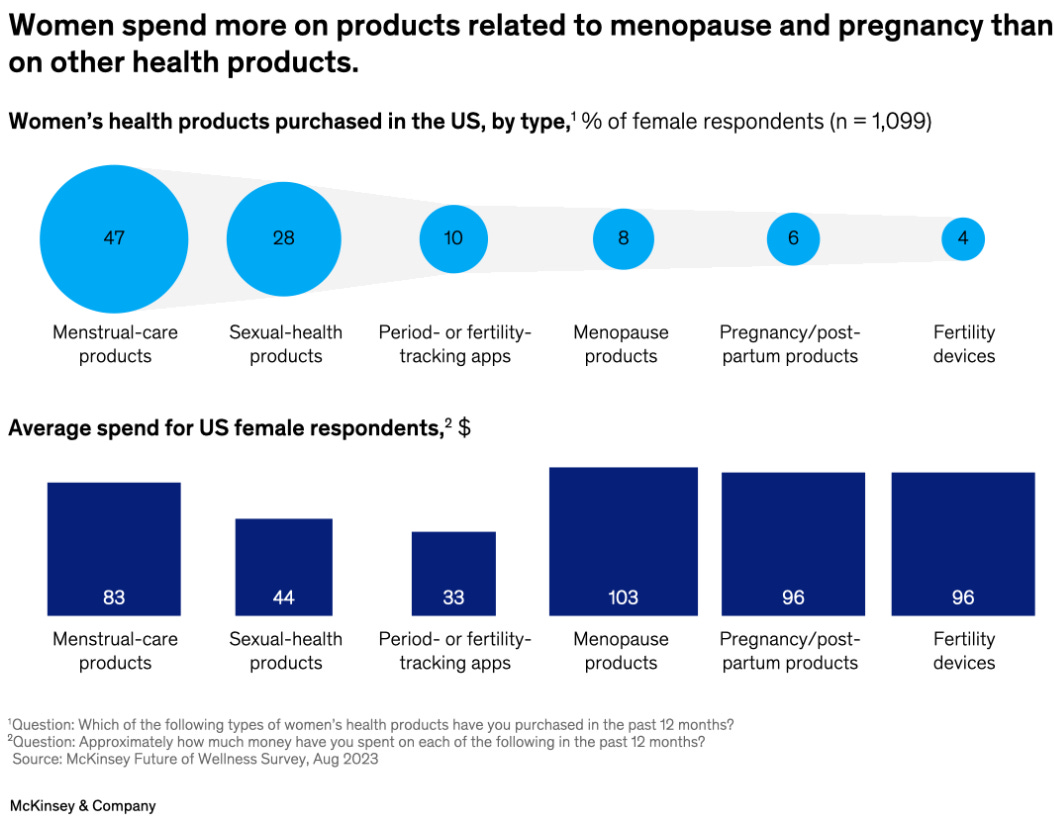

A game changer in women’s health: Congratulations to the team at Teal Health on their FDA approval for the Teal Wand - the first at-home cervical cancer screening tool ever approved by the FDA. Pap smears are uncomfortable and inconvenient, and Teal is now offering women a convenient and accessible method to get the necessary screening. Women’s health has been a rapidly growing segment of the broader health & wellness industry, with McKinsey finding that consumers are typically spending more on fertility, pregnancy and menopause related products than anything else. For a longer list of companies innovating in the women’s health space check out the following post from Maggie Sellers. A focus on women’s health is also proving to be a powerful way to differentiate in traditionally crowded categories - take supplements, for example, where O Positiv has built a standout brand by zeroing in on women’s hormone support.

The tariff mill keeps churning: US and China reach a deal to slash sky-high tariffs for now, with a 90-day pause. The deal lowers the tariff rate from 145% to 30% for Chinese goods coming into the US, within China lowering the rate on US goods from 125% to 10%. The agreement prompted Apollo’s chief economist, Torsten Slok, to slash his odds of a 2025 recession from 90% to 30%. Polymarket, has the odds in a similar place, and the time series provides a nice way to visualize the volatility induced by the tariff roundabout.

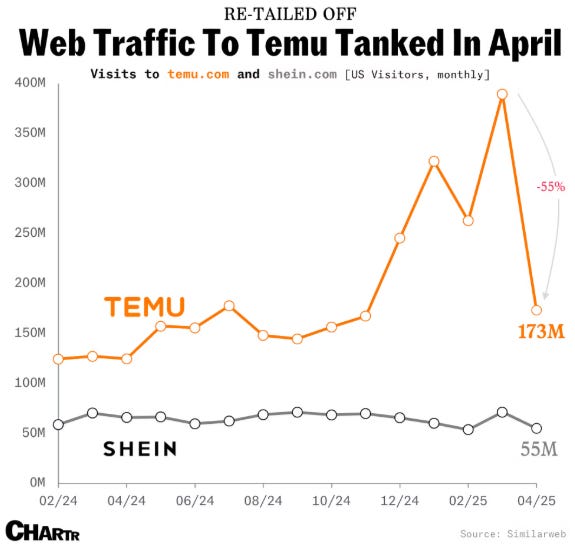

The danger of competing on cost: Temu's sharp decline in the U.S. market underscores the risks of competing purely on price in highly elastic product categories. Following the May 2nd elimination of the de minimis exemption and the imposition of a 145% tariff on Chinese imports, Temu experienced a 55% drop in web traffic in April. Millie Giles of Sherwood News has more here. It looks like they may get some relief as the White House reports levies for those direct-to-consumer postal shipments will be reduced to 54% from 120% for items valued at up to $800, with the alternative flat fee of $100 per postal package remaining in effect.

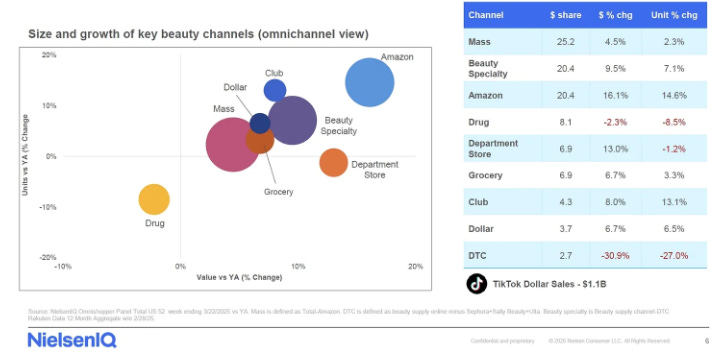

The changing tides of distribution in beauty: Cristina Nuñez of True Beauty offers an incisive analysis of the forces reshaping the beauty industry: (1) Sephora and Ulta disrupted mono-brand prestige retail by empowering product-level loyalty—now Amazon and TikTok Shop are doing the same to them. (2) Amazon, once avoided by luxury brands, is now a vital replenishment channel with high consumer trust and brand-controlled storefronts. (3) Sephora is responding with stricter exclusivity demands to protect its trend curator role—powerful for early-stage brands, but only if tradeoffs are strategically timed. (4) TikTok and Amazon now drive the majority of digital beauty growth, with TikTok Shop converting 44% of U.S. users—visibility on both is table stakes. (5) The most successful brands blend DTC, retail, and marketplaces based on where their consumer wants to shop. Sephora remains the beauty juggernaut, industry tastemaker and is a key channel for emerging brands to cultivate prestige positioning, but there is no doubt the competition is heating up.

From the Archives: Boom & Bust

What can beer teach us about economic cycles of boom and bust? As it turns out, a lot.

Rising input costs are creating friction points across supply chains. From appliances to apparel, brands are grappling with cost pressures, lead time volatility, and shifting demand patterns. Any volatility in a supply chain can have enormous ripple effects, as we saw in COVID. To understand why, we can turn to a deceptively simple model: The Beer Game, developed by MIT’s Jay Forrester in the 1950s.

Game Setup

4 roles: Retailer, Wholesaler, Distributor, Brewer

Each role is played by a different person, with no communication allowed

Players only see local data: their inventory, incoming orders, backlogs

Consumer demand is simulated by a deck of face-down cards seen only by the Retailer

Game Play:

The goal of the Beer Game is simple: minimize total system cost. Each team of four (Retailer, Wholesaler, Distributor, Brewer) works together—without communicating—to meet fluctuating customer demand as efficiently as possible.

Teams incur two types of costs:

Inventory holding costs: $0.50 per case, per week

Backorder (backlog) costs: $1.00 per case, per week

These accumulate weekly and the team with the lowest total cost wins.

How the Game Works:

The game simulates weekly operations: every turn = 1 week.

Each player places one order upstream (Retailer → Wholesaler → Distributor → Brewer) and receives product shipments downstream (Brewer → Distributor → Wholesaler → Retailer).

Only the Retailer sees actual consumer demand, drawn from a hidden deck of demand cards. Other players must infer demand based on orders placed to them.

For the first 3 weeks, demand is steady at 4 cases/week, and all players must order exactly 4 cases per turn. This keeps the system in equilibrium.

Starting Week 4, players can order any quantity, and in Week 5, consumer demand steps up permanently to 8 cases/week—though only the Retailer sees this change immediately.

Players operate with local data only: their own inventory, incoming orders, and backlog. No player has global visibility or forward-looking demand information.

Players are told the game will run 50 weeks, but in reality the game ends at Week 36 in order to prevent any time induced behavioral changes

The Results:

Despite its simplicity, the Beer Game reliably produces extreme outcomes. When demand jumps from four to eight cases in Week 5, the ripple effect through the supply chain is immediate—and exaggerated.

Players at every stage overreact to the increase, regardless of whether they're undergrads or Fortune 500 CEOs.

The same two patterns always emerge:

Wild oscillations in order quantities from week to week

The further removed from the customer, the more severe the swings—order volatility peaks at the Brewer

What the game shows is that a single, one-time increase in consumer demand produces a self-reinforcing boom-bust cycle, without any further changes in actual demand.

In our view, there are two enduring takeaways:

System robustness > better forecasting.

It's more effective to design a supply chain that absorbs uncertainty than to chase better predictions. The illusion of precision is seductive—and destructive.Shared data dampens distortion.

Real-time visibility across the supply chain reduces the bullwhip effect. A real-world example is Walmart’s Luminate platform, which gives suppliers like Procter & Gamble direct access to sales, inventory, and customer data. That transparency enables better planning, tighter inventory control, and fewer overreactions.

The patterns of behavior observed in the game - oscillation, amplification, and phase lag - are readily apparent in the real economy , from the business cycle to the recent boom and bust in real estate. The persistence of these cycles over decades is a major challenge to educators seeking to teach principles and tools for effective management. Though repeated experience with cycles in the real world should lead to learning and improvement, the duration of the business cycle exceeds the tenure of many managers. In real life the feedback needed to learn is delayed and confounded by change in dozens of other variables. By compressing time and space, and permitting controlled experimentation, management flight simulators can help overcome these impediments to learning from experience.

But the biggest impediments to learning are the mental models through which we construct our understanding of reality. By blaming outside forces we deny ourselves the opportunity to learn - recall that nearly all players conclude their roller coaster ride was caused by fluctuating demand. Focusing on external events leads people to seek better forecasts rather than redesigning the system to be robust in the face of the inevitable forecast errors. The mental models people bring to the understanding of complex dynamics systematically lead them away from the high leverage point in the system, hindering learning, and reinforcing the belief that we are helpless cogs in an overwhelmingly complex machine.

We may never have a crystal ball, but there are always ways that we can evolve the system.

P.S. If you are interested in learning more about the Beer Game, or dynamic systems more generally then we highly recommend Eric D. Beinhocker's book The Origin of Wealth as well as this article at MIT's Beer Game page